NZ Initiative goes all in on privatisation

A new report claims to provide "compelling" evidence that privatisation would deliver more "value for money" for New Zealanders. How good is the evidence? Not good.

Well, we knew it was going to happen. After David Seymour “blew open” the privatisation debate with his State of the Nation speech and Christopher Luxon declared that National would campaign on privatisation next election, stating he would consider an election win as a mandate to move the privatisation agenda forward, it was only a matter of time before our friends at the NZ Initiative would come out in favour of privatisation.

Initially, they put an old 1992 report on privatisation “The Public Benefit of Private Ownership: The Case for Privatisation” up on their website welcome page. They must have thought that one was a bit dated and inaccessible and it contained no references to back up their many claims (and it was written under their old name of The Business Roundtable so that seems a bit suspect) so they needed to work on a new report.

Right on cue, they’ve come up with another report to support the government’s privatisation agenda. This report was prepared by Bryce Wilkinson, a Senior Fellow whose career includes working in the New Zealand Treasury, in investment banking, and managing capital firms. Clearly the kind of person you can expect an objective review of the pros and cons of public vs private (corporate) ownership from.

Wilkinson’s report is entitled “The People’s Portfolio: A $571 Billion Question.” As I’ve said before, I really do have to hand it to these people. They really know how to frame an argument to get the most emotive reactions and up their chances that people will buy into their propaganda. Right away we, as citizens of New Zealand, should begin to feel ownership of whatever Wilkinson is going to discuss. This is after all, our portfolio. What’s more, it is worth $571 billion, a staggering amount of money (but a pittance compared to the over $12 trillion worth of corporate interests that NZI represents, as I document here).

NZ Initiative represents at least $12.7 trillion in business interests

The NZ Initiative claims to be a non-partisan independent research and policy think tank. The reality is that it is a lobbying group for international and New Zealand corporate interests.

The report begins with a foreword by the Director of NZI, Oliver Hartwich. Hartwich can often be found writing op-eds about the decline and fall of Western democracy and how that hurts his classical liberal feelings. He relates a personal story about how great privatisation of the telecommunications service was in Germany. Before privatisation, new phone connections would take weeks, there were very few options in terms of phone types and colours, long-distance calls were very expensive. Then Deutsche Bundespost was privatised and was transformed into Deutsche Telekom

The results were remarkable.

Prices dropped dramatically. Service quality improved beyond recognition. The handsets became smaller and wireless. Soon I got my first mobile phone.

By 1999, I had a girlfriend (now my wife) in Australia. What would have been ruinously expensive under the old monopoly had become affordable even for a student. Those infamous crackly lines and dropped connections – once considered simply part of life – vanished into telecommunications history.

This is a nice story, and I’m glad that Hartwich had a good personal experience with his phone service. He uses this personal anecdote (an n of 1 for those researchers out there) as an introduction to Wilkinson’s report, claiming

This personal experience taught me something fundamental about privatisation that Dr Bryce Wilkinson articulates so clearly in this report: when done properly, with genuine competition, privatisation delivers better services at lower prices.

It is not just about changing ownership. It is about introducing the discipline of market forces and customer choice.

I want to call attention to something that happens over and over throughout this report. It is very subtle, but it is used very often by pro-corporate think tanks and proponents as a way to discount or brush aside the often-disastrous effects of privatisation of public services.

Hartwich says here “when done properly, with genuine competition, privatisation delivers better services at lower prices.” This is basically a get-out-of-jail-free card for anyone who needs it. It allows people who need an excuse for the plentiful examples of the disastrous effects of privatisation to just be able to say that the reason it didn’t work, on whatever index of performance: price, efficiency, profitability, savings, etc… is because it wasn’t done properly or because for whatever reason the full forces of the market were not able to be brought to bear—“oh, that’s an example of a privatisation scheme that was implemented poorly” or “the reason it didn’t work was too much government regulation” or “it was only partially privatised, if the government would have sold its stake in the asset, it would have been different” or “well, no one could have predicted the collapse of that industry, so it wasn’t their fault” or “well, the issue was that this was not an appealing area for investors to invest their capital, so no wonder the business folded.” Over and over again, the blame is shifted to either the government, or things outside of business control, the vagaries of the market that no one can predict. In this way, the political choice to privatise is always let off the hook and the effects in the lives of real people are brushed aside.

Despite Hartwich’s claim that Wilkinson’s report “strips away ideology and examines the evidence” in favour of privatisation, this is far from the case. Or rather, the evidence in favour of privatisation differs substantially from the type of outcomes that matter to most ordinary people. The choice to look at profitability, efficiency, return for shareholders and investors as the primary metrics of whether or not privatisation is successful is in itself an ideological choice. It indicates a worldview that prioritises profits and bottom lines over the lives and livelihoods of real people.

As we will see by analysing the evidence, including the evidence that Wilkinson selectively provides, the choice to privatise is an ideologically-driven political choice based on the idea that government is inefficient and should not own and administer services. It is true that in some cases privatisation leads to better outcomes for the public, but this is far from the norm. Where gains are made after privatisation, they are most often gains for corporations and investors, while public benefits are often unmeasured or inferred based on aggregate corporate indices. In many other cases, privatised businesses fail, leaving governments and taxpayers stuck with the bill.

But let’s take a look at Wilkinson’s report and evidence, shall we?

He starts by saying

The New Zealand government valued the assets the Crown owns at $571 billion in June 2024. That represents about $275,000 for every household in the country. The Crown’s asset portfolio includes everything from commercial entities to houses, hospitals, schools and 40% of New Zealand’s land area.

How much of this does the Crown really need to own? This report explains why this is an important question which should be professionally assessed by a non-partisan body.

Putting aside whether the NZI is a non-partisan body (it isn’t), right away Wilkinson starts by getting the reader to feel ownership of the government’s assets. $275,000 for every household sounds like a lot. I would hope that the government is putting that money to good use. In fact, the first chapter is spent labouring over how much of New Zealand the government owns. By some estimates, the figure is as high as 40%. That sounds like a lot. Doesn’t this country belong to the people? Wilkinson is laying his groundwork very carefully in the first few chapters by trying to frame the argument as the people who by rights should own the land vs the government who owns it.

How much does the Crown really need to own? This seems to be a fundamental question that corporate think tanks ask a lot. It’s a frankly bizarre question. I don’t really care how much stuff the government owns as a rule. I don’t think most people do. I’m not really in the business of buying a hospital or a school. Most of us cannot even afford to buy a house of our own. But you know who can? Corporations and property investors. And anything the government owns is cutting into the possible avenues for profit they can exploit. This is the unspoken subtext of the argument.

This is not an argument based on outcomes for the public, it is an argument based on a libertarian ideology about what is appropriate for government to own and operate. The argument doesn’t care about evidence, or it manufactures the evidence it needs. It was telling in a recent interview with Sean Plunket about privatisation, that after being confronted about the issues with privatisation in the past, NZ Initiative’s chief economist Eric Crampton reframes the argument by saying what we really need to be asking is what we think is reasonable for government to own and what services we think it should provide. This is an ideological argument. It is not based on outcomes.

The disconnect between the lived experience of a typical New Zealander, and the focus of Wilkinson’s report, which is clearly on the importance of profitability of any sector, whether public or private, is made stark and clear in the next section

The question is important because, as the report explains, there are deep structural reasons why politicians and bureaucrats cannot be expected to manage assets satisfactorily. It is important because even small improvements in the management of these assets could make a significant contribution towards living standards.

To put the scope for improvements in perspective, in 2022 Treasury put the opportunity cost (what we give up by having money tied up in these assets) of owning these assets comes at around $22 billion per year. This was using its 5% public sector discount rate. Today it would be closer to $30 billion.

Taxpayers who think owning all these assets should produce net revenue that reduces tax burdens should support the case for a serious review.

So Wilkinson begins by convincing us that the government owns way more than it needs to. Then moves on to telling us that the government cannot be expected to manage its assets well. Then gives us proof that the government is wasting our money. Wilkinson’s argument here hinges on him telling us that the thing that should be on the minds of most citizens when they think about government provision of services is whether the government owning the service is making enough profits.

I’m sorry. Did I hear that right?

For me, and I’m sure the vast majority of New Zealanders, the question that is most important is whether or not I can afford to live my day to day life. The thing that affects that is whether the services provided to me by government or the private sector are affordable and reliable. Questions about taxes and profitability come easily to the mind of business interests, less so to the average citizen. I don’t care if the government charges me taxes if they are providing a service. And I certainly don’t care whether a government service is making a profit as long as it is being provided well.

But clearly the question of profitability is first and foremost on Wilkinson’s mind. And it’s kind of incredible how tone deaf the entire report is, because its measure of success of industries that have been privatised is almost wholly in terms of profitability and returns on investment.

For example, in chapter 5, where he presents the evidence that privatised industry does better than government-owned, he gives a number of examples of private vs public New Zealand businesses, showing that annual growth of privatised companies was larger on average than those that remained in public ownership, then concluding

Research published in 2018 documented “significant and consistent evidence that state ownership is negatively associated with firm profitability compared to private ownership”…

More recent evidence supports this pattern. A 2023 study found that between 2015 and 2022 port companies with partial private ownership consistently generated more profit and paid larger dividends than the fully government-owned ones for the same period. Even partial exposure to market forces improves results.

Improves results for whom, Bryce? Measures of success in terms of profitability and increased dividends are likely unrelatable and inconsequential to the average person impacted by privatisation. Advocates of privatisation love to frame the issue as being whether the public are getting the best return for their investment, as if privatising will give all of us the opportunity to invest in something now that the government doesn’t own it. But that’s not really how it works because most of us aren’t going to share in the increased profits that result from privatisation. If we’re lucky, we’ll experience better and cheaper services. But, as shown by New Zealand’s own experiment with privatisation and many others globally, that is far from guaranteed.

Reading Wilkinson’s report, one would be forgiven for assuming that the majority of evidence indicates that privatisation works well and delivers improved and cheaper services whenever and wherever it is implemented. After all, he cites several positive examples and leads us to believe that this is the standard across the world.

But even his own sources indicate that the picture is far more complicated than he lets on. For example, the study he cites as a “more recent and much-cited authoritative survey article” that definitively shows that privatisation works does nothing of the sort.

I guess it depends on what you mean by “works.” In terms of profitability, privatisation often increases profitability and investor returns, but this can come at the expense of workers and the quality of service. Aside from the predominant supporting evidence for increased profits, value for shareholders, and efficiency (defined by increasing outputs from fewer inputs—often by firing workers—not better service), the study reviews results from many studies of privatisation implementations from around the world and offers the following summary statements from individual studies (just a few of dozens throughout the study)

Mixed results. Outright performance improvements after privatization found in less than half of firm measures studied.

Concludes privatization very positive for telecoms… Much less scope for productivity improvements for airlines and roads.

Documents significant declines in price of phone service… and significant improvements in service levels. Shareholders also benefited significantly.

Deregulation and privatization both… have no consistent impact on service quality. Deregulation associated with lower prices and increased employment; privatization has the opposite effect.

Documents a 370% improvement in labor productivity and a 78.7% decline in employment (from 92,000 to 19,682).

Restructuring/privatization… resulted in performance cost reductions of 5% per year. Producers and shareholders capture all this benefit and more. Consumers and government lose. Shows that alternative fuel purchases involved unnecessarily high costs and wealth flows out of the country.

Competition is significantly associated with increases in per capita access and decreases in cost. Privatization is helpful only if coupled with effective, independent regulation.

Prospective and actual competition both bring about productivity and quality improvements and lower prices for telecom services, but no clear effect was found for privatization.

Far from overwhelming evidence of success.

Wilkinson’s rose-tinted glasses tip over into straight-up dishonesty when we actually look at the evidence he cites, something I guess he’s not expecting the average reader to do. I mean, I guess that if your metric is profitability, most of the time privatisation “works.” If all you’re interested in is how well a company “performs” after privatisation, you’ve got loads of data showing performance increases.

But the argument made to the general public by Wilkinson and others is that privatisation will end up being a better investment—meaning better and cheaper services for your average New Zealander—than public ownership. And on this score, Wilkinson cannot even point to more than one example from New Zealand’s history (Telecom) that actually worked well in terms of delivering better service to the average person. As I said above, most studies of this sort don’t even bother to ask about whether service improved, they just infer it from increased “efficiency” and “productivity”.

But even Wilkinson’s data here are suspect. The paper that he references as evidence of increased customer benefits doesn’t even measure these directly, but rather references another paper that measured them. And this paper only measured customer experience indirectly as well, through such measures as “penetration rate of electronic exchanges” and “number of customers waiting at the last day of the month for services.” They conclude that “although there was an increase at the time the regional operating companies were established, the number of customers waiting for service has become negligible.” No data are presented to let us know what “negligible” means.

They also indicate that “Total faults have halved since mid-1988 and exchange downtime has fallen dramatically.” Following a period of increased exchange downtime at the point of establishment of the ROCs, exchange downtime returned rapidly to pre-privatisation levels, “repeat faults have proved more resilient and have fallen only slowly.” But the total faults, which conveniently omit repeat faults, have been halved since privatisation. They conclude that quality has improved.

They then provide an estimate of changes in “aggregate welfare that have flowed from Telecom since 1987”. These are measured as “changes in producer and consumer surpluses” that assume unchanging demand for telecommunications services and “take no account of costs or benefits shifted to other sectors of the economy.” In other words, based on an abstraction of a complex societal interaction into an exchange between contrived economic forces of supply and demand—a scenario that bears no relation to the way things work in the real world—they conclude that aggregate welfare increased due to the privatisation of Telecom.

And this is the data that Wilkinson cites (secondhand) as evidence for increased customer benefit and quality.

Despite the uniformly positive reviews that Wilkinson gives privatisation in New Zealand, other assessments have been much less laudatory. A Treasury report from 2010 reviewed the trajectory of nine companies post privatisation. The actual details of the privatisations are technical and include various degrees of partial and full privatisations. The status of these companies showed a range of outcomes. Some were brought back into public ownership after period of low and stagnant productivity (Ports of Auckland, Tranz Rail). Some experienced difficulty and required huge cash infusions from the government even after being privatised (BNZ and Air New Zealand). Some have been mostly successful—as indexed by shareholder return—despite associated market volatility (Telecom, Trustpower).

What is clear from these examples, is that, despite Wilkinson and NZI’s assurances, there is no way to tell ahead of time whether privatisation is going to work out. Throughout the report, Wilkinson frames the issue as being related to government debt, stressing the point that if the government has too much debt, they may need to sell off some of their assets. It has already been discussed elsewhere why the government should not be thought of as operating like a household, and therefore this idea of government debt is not helpful and is clearly just a manipulation tactic.

What about other indices of privatisation “success”? One of the things that people like Wilkinson always say is that privatisation will make things cheaper. As with anything, one can always point to examples where this is the case. But there is a lot of evidence showing just the opposite, including in the papers and reports that Wilkinson cites in his report.

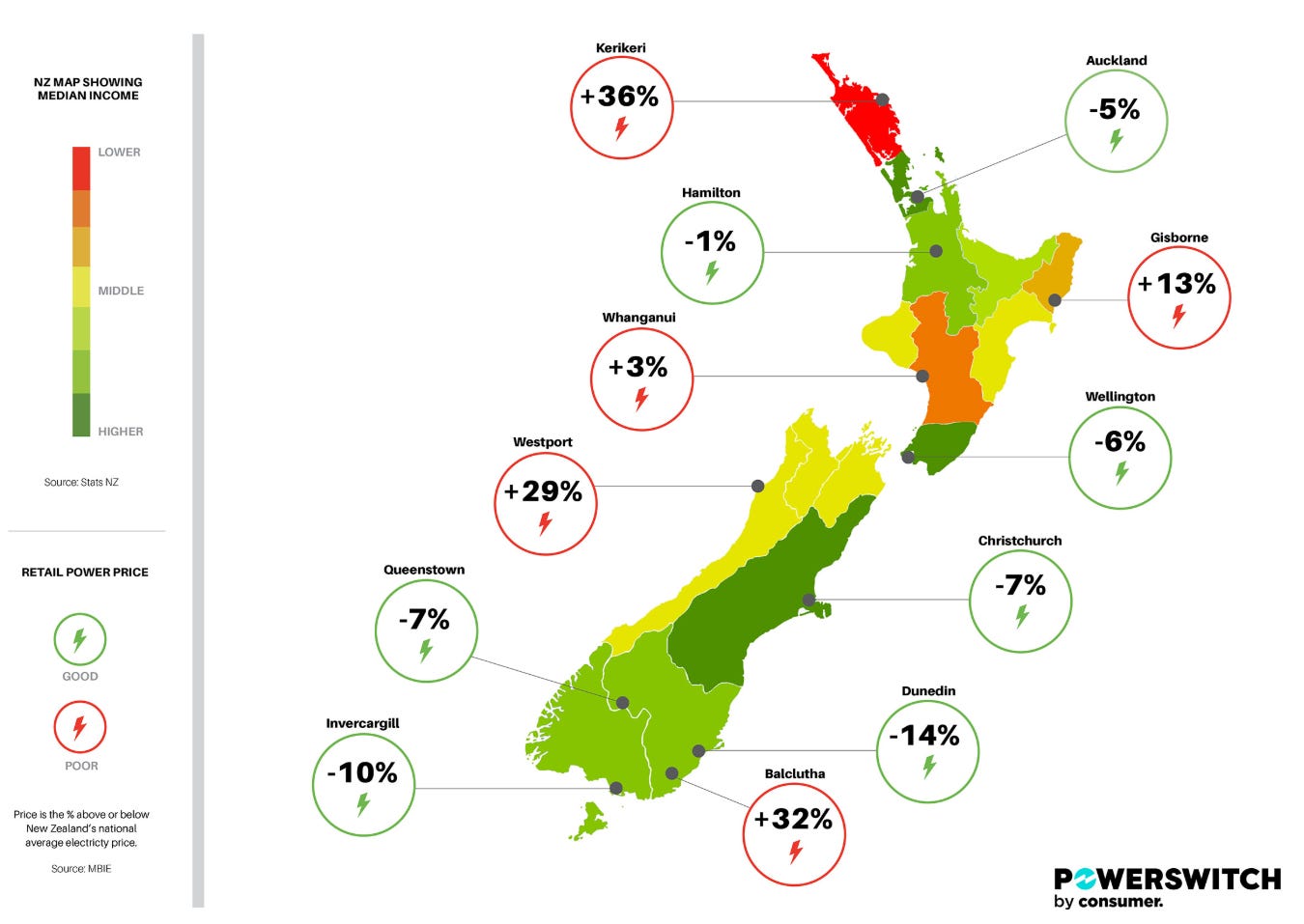

Things get even stickier when you break down changes in price by region. As an example, Consumer NZ did an analysis of energy prices in 2021. Energy was privatised by the National government beginning in 1999. The analysis is shown below

What the analysis shows is that more urban places in the country pay less for their energy than more rural areas, sometimes much less. This result means that those on lower incomes pay more for their energy than those who are more wealthy, something known as “energy poverty”.

This example gets to the heart of why privatisation hurts the public. Corporations and businesses exist to make profits, not to provide services. They will provide services because that’s how they are able to make their money, but if the provision of services cuts into their profits, they will always shift the burden onto the consumer in the form of increased prices. Power provision is more expensive in rural areas due to the increased infrastructure requirements. So this increased cost is passed onto the power customers in these areas. This is just the way business works. This was further evidenced by the fact that when the postal service and some of the banks were privatised, service in many rural areas was simply discontinued. It didn’t matter that people actually needed the service. What mattered was whether it was profitable.

Government on the other hand, has as its goal first and foremost to provide services, not to make profits. Because of this, it will spend money to provision services at the lowest cost to the public and it will not pass on increased provisioning costs selectively to certain groups. Furthermore, if certain groups are unable to afford a given service, government often subsidises those individuals so they can afford the service more comfortably.

For Wilkinson, there should be nothing shielding the public from the full brunt of the market forces. He slams government subsidies throughout his report. If privatisation results in higher prices, it’s still working from the perspective of following the logic of the market. Subsidies distort the market. In his section addressing the fears much of the public have that privatisation will result in price increases due to price gouging or elimination of government subsidies, he offers this thought

Where a good or service is subsidised, the cost to the community of suppling [sic] it will likely exceed the price charged. Price rises when subsidies are reduced or eliminated are not necessarily bad.

Don’t worry about the price increases. They aren’t necessarily bad. What is bad are government subsidies. We should all just agree on this and move on.

Another area that Wilkinson glosses over is the impacts of privatisation on employment. He cites one study that found a job loss rate of only 10% after 3-4 years as evidence that people should not be concerned with loss of employment after privatisation. In another NZI report from 2002, those who are concerned about the loss of jobs after privatisation are consoled with this

Many jobs were lost in New Zealand as the old state departments were commercialised and privatised. But the jobs lost were not viable ones: rather, they were, in effect, highly expensive welfare benefits.

That should make us feel better about these job losses. These people were basically on the dole anyway.

While Wilkinson does the smart thing and doesn’t give any numbers about job losses, others have tabulated them for us. In just the three year period from 1987 to 1990

Coal Corp reduced its staff numbers from 1861 to 715, Telecom from 24500 to 16263, Electricorp from 5999 to 3690, Railways from 14900 to 8400, and New Zealand Post from 12000 to 8500.

Overall, from 1985-1995, 30% of the public sector lost their jobs. Unemployment peaked at 11%. These decisions had a massive impact on the lives and livelihoods of normal working people.

People like Wilkinson go to great lengths to convince us that the levels of job loss weren’t really that significant because people got jobs in other areas or the influx of investment created more jobs. As I said above, in some cases this is true, but it cannot be determined beforehand. Many people simply lose their jobs. Most analyses just chalk this up to increased “efficiency” or “productivity”. As usual, the economists hide the human faces behind the analyses.

Those who are concerned with such things, however, have noted long-lasting effects on communities of the job losses suffered under privatisation. An analysis by the Motu Economic and Public Policy Research group in 2008 found that structural changes during privatisation resulted in many instances of what they term “employment shocks”. They further found that the degree of employment shock corresponds to the degree of employment, skill of the workforce, and average incomes in an area and that these effects are still felt after 10 years. In other words, rapid large-scale job losses (as are often experienced under privatisation) can set a community up to struggle for many years.

I could go on and on about this report. The more I read it, the more issues I find. The arguments in favour of privatisation are shifting and poorly supported, and the whole report is an exercise in creating an idea of something that Wilkinson thinks the public should care about and then giving us reasons why privatisation will fix the thing that most of us aren’t that worried about in the first place. It’s a disingenuous and flatly dishonest report which hedges its conclusions based on selective citation of its own sources and on the basis of whether or not privatisation has been “done well.”

The underlying issue is there is never a way to tell beforehand what the outcome of privatisation will be. Furthermore, the outcomes that businesses, corporations, and the economists who carry their water are looking for are not the same outcomes that the public wants. We are sold a narrative of increased efficiency and productivity that has little if anything to do with the way that privatisations impact the everyday lives of the public. The history of privatisation in New Zealand is a history of massive layoffs, whole communities decimated by the shuttering of industry, huge transfers of wealth to the already wealthy, including massive transfers of wealth out of the country, and price increases for the poorest among us.

Wilkinson’s report changes none of that. He knows it, and so all he can do is reframe the debate and change the terms by which to judge the success of privatisation. Terms which say one thing and mean another, trying to sell the public something they know doesn’t work at the behest of his corporate bosses. Combined with the austerity and deregulatory measures and the weakening of worker protections under the current government, it only makes sense that another round of privatisations is on the way. What’s good for business is good for New Zealand, after all.

We have an exceptionally good example of why we shouldn't privatise NZ any further. Energy. Last year consumers and businesses paid high energy prices. It couldn't be helped because... the market. Off the back of that Genesis Energy has just posted record profits. It's all a choice and private companies presented with a captive market will price gouge. Now imagine your health care with extremely limited regulations and competition being privatised. Seymour likes to talk about $5000 insurance policies.... try 10 times that.

They use those techniques in every report, it does get obvious when you read enough of them but how many people are dull enough to do that?? 😅 Good breakdown of the rhetorical devices used to grab an audience and win them to their ideas.

The fact of the matter is, even if free market privatisation with competitive elements was the way to go, New Zealand is just not big enough. We are tiny. We are not Australia. We are not America. We are not a European country with land borders with 4 other nations. We are stuck at the bottom of the world and actually really quite insular. We are leeching money out overseas simply through trade which weakens us an economically overall far more than any government debt invested in our infrastructure or our people.

Not a good idea, not a good match for us, not good timing, not good implementation I would expect. Just bad all around.